UK Animation Industry Sees Huge Boost in Film Production

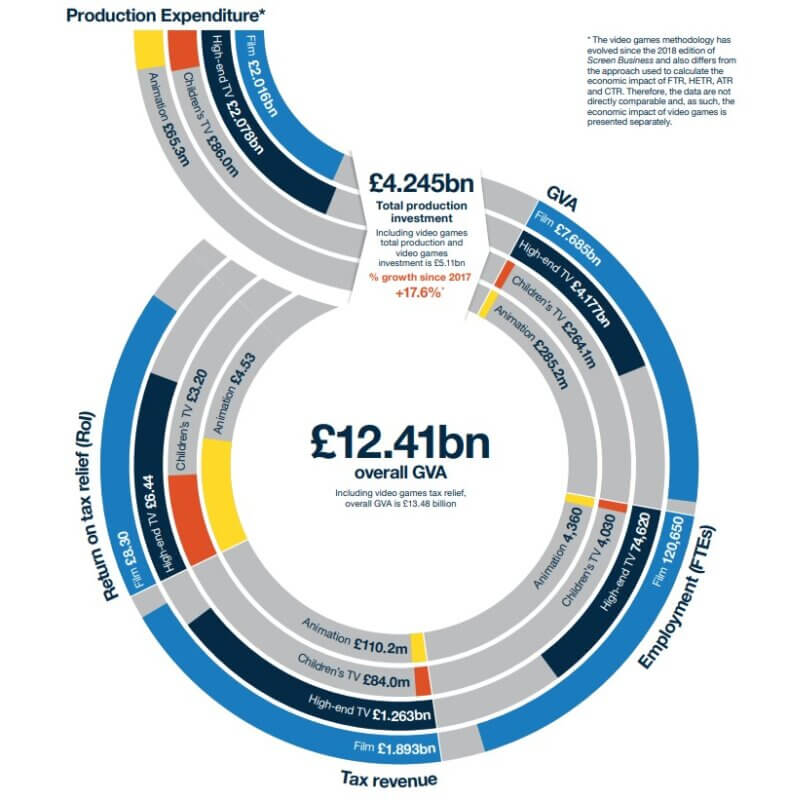

The BFI has released vital new research demonstrating the positive impact of tax relief on output across the screen industries. The Animation Tax Relief was introduced thanks to the successful campaign led by Animation UK in 2013. Since then, production spend figures related to tax relief have significantly impacted every part of the sector.

Although this research shows a downturn in production expenditure in relation to the specific Animation Tax Relief in the period up to 2019, the bigger picture is revealing. Whilst production spend on animation for TV and online dipped, there has been a significant increase in Animated films from £80m in 2016 to £520.4m in 2019. Combining the figures for Animation film, TV and online, we see an increase in animated content overall. The ecology of the industry (business model and workforce) is interdependent. Work on features films, inward investment in animation services and sequences provided for international commissioners is increasingly lucrative.

Production spend represents just part of the broader value of the Animation sector, reflecting the importance of tax reliefs to support new brands and the creation of downstream revenue. Further research will capture the value of broader sectors (advertising, corporate and education) plus the ancillary licensed products that it generates, such as children’s DVDs, books, theme parks, toys and clothing and the licensed merchandise sales market for the UK animation sector.

As a sector that proved Covid resilient and with the combination of a growing international market, we are currently seeing a bounce in production levels, but these figures show we can’t be complacent. But it is a highly competitive market. The sector is facing many unique challenges. We need to ensure we are offering competitive tax incentives that create the right conditions for growth and incentivise retention of IP. The global market is huge and growing, and we are determined to increase our market share. Reviewing tax reliefs will be an important part of our plans, and this report provides the basis for these conversations with partners and the Government.

Kate O’Connor, executive chair at Animation UK

The UK has a long history of producing world-beating Animation IP, when we can own and exploit that IP, not only are we educating and entertaining children right around the world we can also bring in a lot of money to the in the form of new jobs and new business. Our key competitors are offering government-backed incentives to attract animation work. Despite our reputation, there is not a level playing field. UK producers and studios are already challenged in putting together funding packages due to reduced UK commissioning budgets and in the UK. They are increasingly having to resort to co-production with a business operating outside the country, losing a significant proportion of IP rights in the process.

Oli Hyatt, Managing Director and Co-founder BlueZoo

At a time of unprecedented demand for content, it is a genuine concern if the ATR production spend continues to decrease. That said, we have one of the best global production centres for animated content, Jellyfish Pictures has invested extensively in growing our studios across the UK, we are the most geographically diverse of the screen sectors, and it would be a huge loss to lose that production spend to other countries. To compete globally, we have to keep up with the tax credits offered elsewhere.

Phil Dobree, CEO Jellyfish Pictures.